The Bend Bulletin

You may have heard the talk: The state’s Public Employees Retirement System’s benefits for its newest members are not much more than a 401(k), the defined-contribution plan that’s become common in private business.

It isn’t. Yes, new PERS members have a 401(k), but that isn’t all. Not only will public employees in the newest tier, Tier 3, receive a defined-contribution plan akin to a 401(k), but they also will receive a defined-benefit retirement plan.

The defined-contribution component is funded by a mandatory contribution amounting to 6 percent of an employee’s earnings. This money, as in a 401(k), is invested and grows during an employee’s working life and is paid out in retirement.

There’s a catch, however. For some 60 to 65 percent of Oregon’s public employees, that 6 percent contribution actually is paid by their employers — taxpayers. While some private employers do, in fact, contribute to workers’ 401(k) plans, few actually bear the full cost of the program. That means that more than half of public employees in Oregon do not have any of their own hard-earned money directly tied to their retirement income.

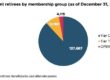

Public employees who are covered by older, Tier 1 and Tier 2, plans get even more. Tier 1 employees, those hired before 1996, get a guaranteed rate of return equal to the assumed earnings rate, no matter how the market actually performs. They may retire at 58. Tier 2 members get the market rate of return and may retire at age 60. Retirement for Tier 3 employees is age 65.

Public employees generally have generous health benefits while on the job, as well. The state’s Supreme Court has said clearly that public employees must be paid what they’ve been promised upon retirement, and we agree. A promise is, after all, a promise.

But that must not keep lawmakers from continuing to find other ways to make public retirement something that’s not destined to cost school districts too many teachers and public safety offices too many cops and firefighters. So far the Legislature has been reluctant to do that.

Editor’s note: This editorial has been corrected to remove incorrection information about health benefits.