Oregon’s Structural Fiscal Deficit

Threatens Services, State Economy

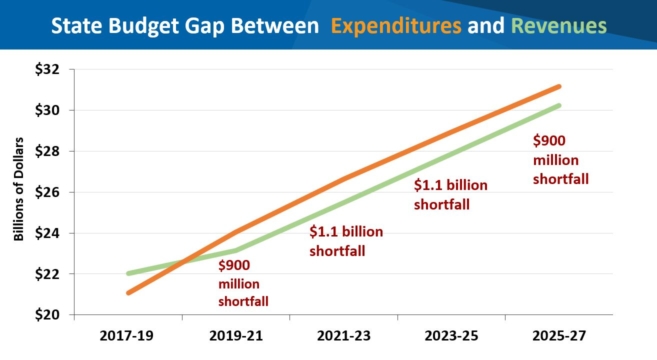

Oregon is caught in a growing fiscal bind that threatens to rob current and future generations of quality public services while damaging Oregon’s economic resilience. The Oregon Business Plan is developing ideas and options for elected leaders to consider as they address this issue in the 2019 Legislature. (See Time to Act, our policy proposals for putting Oregon’s fiscal house in order.) Our ideas include spending and revenue reforms designed to enable increased investments in education, health care, and other public needs vital to Oregon’s life and economy.

Multiple factors drive Oregon’s fiscal crisis:

- Public Employee Retirement System payout rates are marching toward 30% or more of public jurisdiction payroll.

- Health insurance costs for state employees are 50% higher than the national average.

- Reductions in federal Medicaid support (the basis of health care for 25% of Oregonians) shift a greater burden for low-income health care to the state.

- Oregon’s unstable tax system lacks sufficient reserves to weather future recessions.

Fiscal Initiative Takes Aim at the Problem

Based on policy analysis shaped over the past two years, the Oregon Business Plan launched the Fiscal Initiative at the beginning of 2018. The purpose of this work is to lay out the perspective of business leaders and our community partners on what Oregon should do to assure economic growth, bring government expenditures and revenues into alignment, and make targeted investments in education, health, and other vital services. The goal of the work is legislation that restores fiscal balance, but also makes fiscal choices that break our damaging cycle of intergenerational poverty, raise education attainment, and improve the lives of Oregonians.

Work Looks at Cost Control, Revenue Reform

The Fiscal Initiative follows the three-part strategy outlined in the Oregon Business Plan for restoring Oregon’s fiscal health:

- Grow the economy, which is the best way to raise wages, lift people out of poverty, and increase revenues for public services.

- Slow the growth of unsustainable costs in PERS and other public spending that impinge on service budgets.

- Reform the tax code for greater revenue stability and increased funding of targeted investments in education, health, and other priorities that produce better outcomes for Oregonians.

The work of the Fiscal Initiative is being carried out in four areas guided by business leaders and including other community partners. The four areas are:

- Cost containment

- Tax reform

- Investments in education and workforce

- Investments in health and health care.

Process Involves Stakeholders Statewide

The Business Plan’s principal partners include the Oregon Business Council, Oregon Business and Industry, and the Portland Business Alliance. However, successful development and execution of the Plan requires involvement and support from leaders across business groups, industries, regions, and political affiliations. Over 2018, the Oregon Business Plan visited communities and industry groups across the state, along with elected leaders and candidates, editorial boards, and others, to help develop, refine, and seek support for policy ideas and options. Findings and recommendations from this process will be presented at the December 2018 Oregon Leadership Summit and then advocated in the 2019 Legislature.

For Further Information

If you have questions, would like a presentation, or would like to participate in the effort or contribute to it, please contact Jeremy Rogers, Fiscal Initiative Project Manager, info@oregonbusinessplan.org.